Nonstop Points has partnered with CardRatings for our coverage of credit card products. Nonstop Points and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. This post may contain affiliate links; please read our advertiser disclosure for more information

When students are finished with high school and are off to college, they will eventually realize that they are no longer living on their parents’ dime. Sooner or later they are going to need to provide for themselves. Now, most college kids are going to be pretty broke throughout this period. Some might have jobs, but even if they do, most will be low paying ones.

When it comes time for spring break, and they might want to head to Cancun or Daytona Beach with their friends, how will they afford the trip? If they want to go backpacking through Europe over the summer, how will they ever be able to do it?

Earning Points and Miles

Using points and miles is the way that makes the most sense to me. Even a small stash of points should be enough to buy flights for a student. As long as the student is responsible with the use of credit cards and smart with money, they should be able to travel for free. Here’s how:

In this example, let’s say that this student is 21 years old going to a school in the Los Angeles area. In addition, after having at least three years to build credit (if not more by starting before 18), this student has a good credit score and financial mindset. Finally, over the past three years, this student has created a Chase bifecta (two cards that go well together) in order to have an overall low annual fee and keep it simple. In this case, the student will only have two credit cards, the Chase Sapphire Preferred, one of the best beginner points cards, and the Chase Freedom Unlimited, one of the most simple cards.

Although signing up for a singular credit card can often cover at least one trip, if not two by flying in economy, for this example let’s say that this particular student is not going to sign up for any new cards. If the student wanted to earn more points though, as long as he/she could meet the minimum without spending more than otherwise would be spent, this student could earn tens of thousands of additional points.

That student will overall be earning 2x Chase Ultimate Rewards Points on dining and travel through the Sapphire Preferred and another 1.5% through the Freedom Unlimited that can be converted into points.

If the student is living off campus and without a meal plan, this is an estimated guess of how much would be spent. In one month, $250 on groceries, $350 on eating out including Starbucks and bars, $250 on transportation (Uber, scooters, etc.), $200 on clothing, and, finally, $150 on miscellaneous including books. Please take into consideration that in this example the student’s rent is completely separate. The student would be spending $1,200 a month. If the student is smart, and purchases clothing online through a shopping portal, he/she can regularly get an additional 3x points per dollar spent.

When you add it all up with the multipliers, this student is earning roughly 2,700 hundred points per month. Now let’s say that the student lives at home three months a year over the summer and, hypothetically, does not have any expenses. While that does not seem like a lot of points, when you multiply that by nine months a year when school is in session and the student is living in LA, it adds up to 24,300 UR points, a more significant figure.

Using the Points and Miles

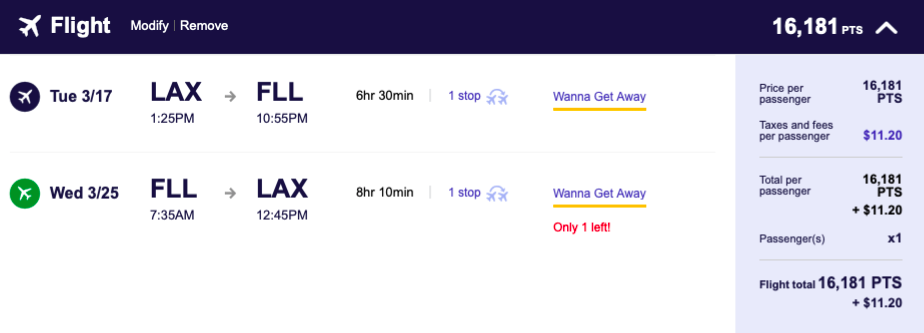

If, over spring break, that student wanted to go to Miami with friends, then instead of having to foot the bill, they could transfer the points to one of Chase’s transfer partners, like Southwest. Using only 16 of the 24 thousand points, the student could fly to a break destination and still have some points to spare.

The Last Point

With a student’s low spending, the points can add up. A $6 drink at Starbucks is at least 12 points and a $9 cocktail at a popular bar is another 18. It adds up faster than you think. If a student maximizes spending (by getting the most out of every dollar spent), then they can have the ability to save when travel is wanted.

It is important for young adults to start good financial habits early in life, and this is just one way to start a future of financial success.

Nonstop Points has partnered with CardRatings for our coverage of credit card products. Nonstop Points and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. This post may contain affiliate links; please read our advertiser disclosure for more information

Leave a Reply