Nonstop Points has partnered with CardRatings for our coverage of credit card products. Nonstop Points and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. This post may contain affiliate links; please read our advertiser disclosure for more information

As a student on a limited budget, I am always looking for ways to save money on my day-to-day spending. And, although I always make sure to earn points and miles while spending, credit card linked offers have helped me save money on everything from flights and hotels to sweatpants and groceries.

What most people do not realize is that card linked offers hide in plain sight and are very easy to maximize as long as you know where to find them. Here’s all you need to know about card linked offers.

Save Money on Everyday Spending

Multiple credit card products provide ‘offers’ that can be added to their card. Once that card meets the requirements specified in the offer, the bonus or discount is triggered. Think of using coupons. Rather than using a coupon for individual products like Tide detergent or strawberries, you are receiving a discount on merchants as a whole such as Adidas or Hilton Hotels.

Let’s say I was deep into a good movie and started getting hungry. Knowing myself, I would open my DoorDash app and look for the most appetizing restaurant option available. The issue is that even after the delivery fee is discounted, thanks to Chase’s partnership with DoorDash, it is still pricey for food for a college kid on a budget. But luckily, I am able to use a Chase credit card linked offer to save a little bit on the expenditure.

Chase is offering 10% back on my DoorDash purchase on up to $50 in spending. While this is not any crazy discount, it will at least pay for a portion of the driver’s tip. Over many purchases, these discounts can add up to a truly significant amount of savings.

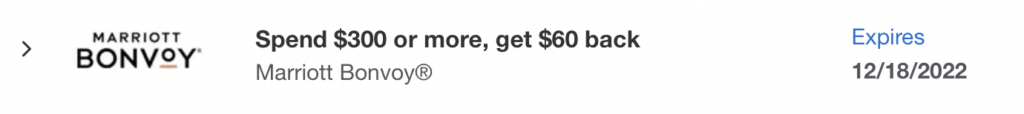

On the other hand, I have had offers, which discount hotel stays by $60 or more, which really begins to add up when used throughout the year.

Where Do You Find Card Linked Offers?

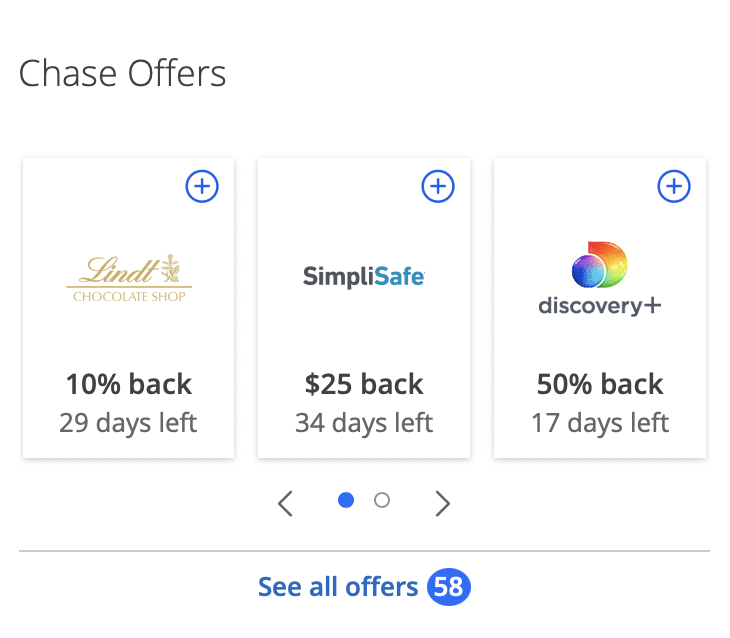

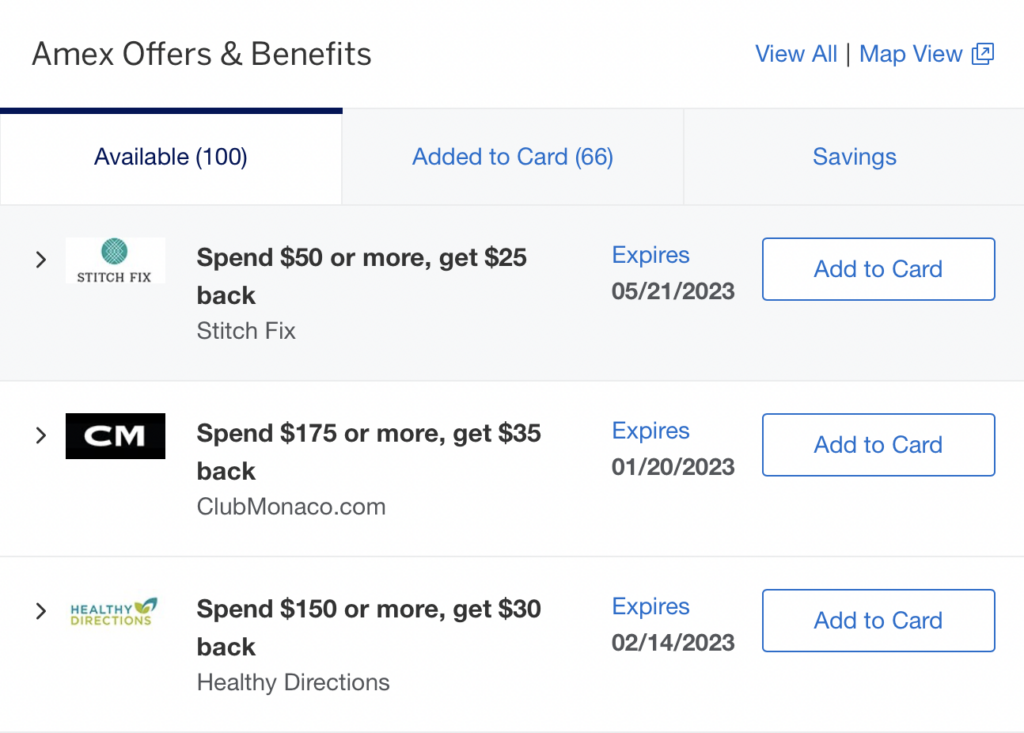

When you log into your credit card account, most issuers have a section dedicated to offers. For example, on my Chase card there is a section dedicated to ‘Chase Offers’, or for American Express, there is an area where you can click on ‘Amex Offers’.

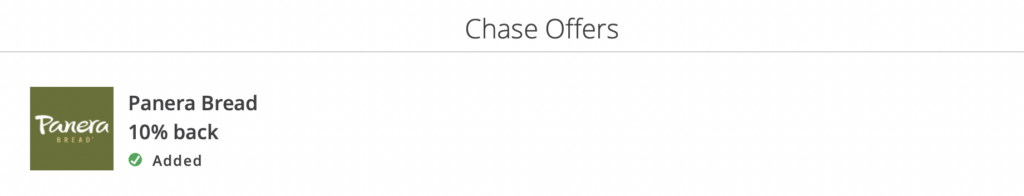

Once you are in the ‘offer’ domain, there will be a list of available offers, which usually changes monthly. All you need to do is select the offer of interest and click “Add to Card”, or the little check mark for the Chase card, which will link the offer to the credit card. For example, if I select and add the Panera Bread offer from Chase, all I need to do is use that Chase card next time I visit Panera and the discount or bonus will be activated.

Once the system in place recognizes the charge, the 10% back will appear as a statement credit on my credit card bill, which effectively reduces the cost of the purchase. Undeniably, this is much easier than clipping and using paper coupons.

I advise people to add as many offers as they can to their card for multiple reasons. For starters, even if you do not plan on visiting that particular store or making a purchase, if you happen to, it’s a bonus discount without having to think about it.

Additionally, American Express will only show 100 offers on your account. This means that potentially good offers that are targeted for you are not appearing. Adding the offer to your card will allow more offers to appear and potentially allow for further discounts.

The only caveat to this strategy is that American Express currently only allows you to link an offer to one card, even if you have multiple American Express cards. So, if you have offers for hotels, it is best to link hotel offers to a card that’s best used for hotel stays in order to double dip and maximize the points earned for a hotel stay. The same applies to a restaurant offer and a card that works best for dining.

The Last Point

I have personally been able to save hundreds of dollars across all of my cards on most of my purchases. A few dollars a statement credit or a few hundred points may not seem significant, but when you realize how much you spend in a given year, 10% can make a huge difference.

All thanks to one extra click, I am able to keep a little bit more money in my wallet that I can save and use to continue traveling.

Nonstop Points has partnered with CardRatings for our coverage of credit card products. Nonstop Points and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. This post may contain affiliate links; please read our advertiser disclosure for more information

Leave a Reply