Nonstop Points has partnered with CardRatings for our coverage of credit card products. Nonstop Points and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. This post may contain affiliate links; please read our advertiser disclosure for more information

Let’s face it: currency exchange can be confusing. The lack of transparency often leads to questioning if you are getting ripped off or paying exorbitant fees. This is exacerbated by rapidly changing exchange rates, especially in inflation-stricken countries.

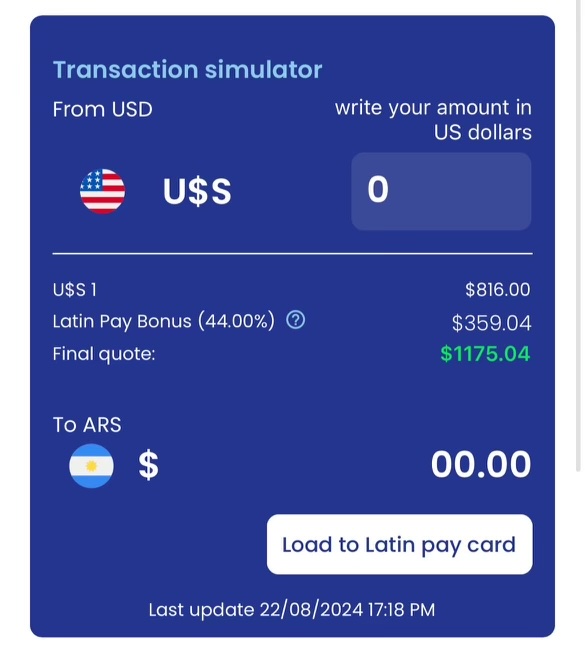

This is certainly the case in the South American country of Argentina, where inflation has recently been more than 100%. There are several legal exchange rates in Argentina, and only some are accessible to tourists. At the time of writing, the official exchange rate was 986ARS to 1 USD while the Blue Chip Swap rate was 1220. Thankfully, Latin Pay is transforming the way travelers spend to benefit from a better exchange rate while exploring Argentina.

*Please note that Nonstop Points has no financial or affiliate relationship with Latin Pay. However, this article was written at the request of a reader who recommended the product.

Latin Pay Use Case

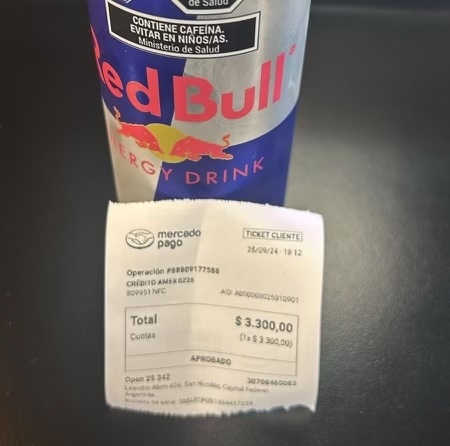

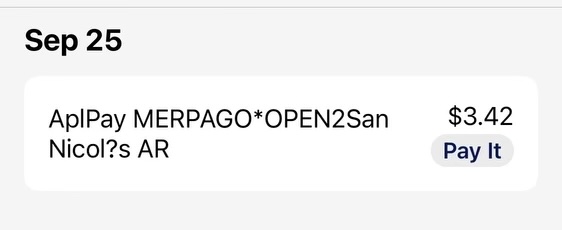

Imagine you were buying a Red Bull for 3,300 pesos but charged it to your typical American credit card. If you are smart, you will avoid a 3% foreign processing fee with a good travel card. However, with the bank conversion, it will come out (at the time of a tested transaction) to $3.42.

However, if you were to use Latin Pay and load your card with 3,300 pesos for the transaction, it would charge your credit card and only cost you $2.81 based on the 1175:1 exchange rate being offered on the app.

This is 18% savings on the same transaction of Red Bull with marginally more effort. Over an entire trip, including hotels, dining, and activities, that 18% can easily add up to thousands saved. For instance, if you were going to spend $3,000 USD in Argentina, you could easily save $540 with Latin Pay.

Latin Pay, an innovative fintech startup, offers a solution with a pre-funded, reloadable VISA card in a digital wallet that provides travelers with convenience and control over their exchange.

Here’s why Latin Pay is revolutionizing the exchange game:

Seamless Local Payments with Latin Pay

Latin Pay’s most significant feature is its ability to allow travelers to pay like locals, removing the extra charges that are often associated with foreign transactions. This means you can confidently make purchases during excursions, pay for your accommodation, and settle bills at restaurants without worrying about hefty international fees.

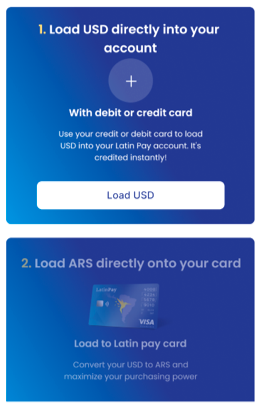

Latin Pay allows you to load US Dollars directly into your account. You can even load your balance using your debit or credit card! This means you can still earn precious credit card rewards while saving on exchange rates – a win-win!

The balance will be available instantly. Then, you can convert your US Dollars to Argentinian Pesos onto your ARS card to maximize your purchasing power. You do not need to convert USD at once, but rather as you need to make purchases. This is important as it protects you if ARS depreciates during your trip.

Cost-Effective Money Transfers

For travelers who need to send money from abroad quickly and safely, Latin Pay is transparent and easy to use without lines and paperwork. You can transfer money from more than 150 countries to Argentine pesos.

The exchange rate can easily beat what even your no-foreign-exchange-fee credit card can offer, giving you a better bang for your buck. While Western Union gives a similar exchange rate, Latin Pay is no hassle. You can have the pesos with several clicks on your phone and without having to stand in line or carry a wad of cash in the streets.

This feature can be particularly useful for long-term travelers or digital nomads who are traveling over significant periods and want to avoid additional costs.

Cash Access Made Simple

Accessing cash in foreign countries can often be a challenge, but Latin Pay has you covered. The platform allows easy cash withdrawals through ATMs and participating merchants. You can even transfer funds to your bank account if needed.

Accessibility

You can request your Latin Pay card for free, and there are no maintenance fees. When you receive your card, you can use it across the broad Visa network for your purchases.

Even better, the app allows you to track all transactions in Argentine pesos instantly.

The Last Point

Latin Pay is more than just another card; it’s a travel payment solution that is perfect for addressing the unique financial needs of Argentina travelers. By offering seamless exchanges and local payment capabilities, this empowers travelers to focus on creating unforgettable experiences rather than worrying about financial logistics.

Whether you are exploring the streets of Buenos Aires or trekking through the Andes, Latin Pay ensures that your exchange needs are met with efficiency and ease. As the travel industry continues to evolve, products like Latin Pay are leading the way in making global exploration more accessible and enjoyable for everyone.

Nonstop Points has partnered with CardRatings for our coverage of credit card products. Nonstop Points and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. This post may contain affiliate links; please read our advertiser disclosure for more information

So maybe questions… How do credit cards not flag this as a cash advance? It’s a currency equivalent… Something tells me this will get flagged quick