Nonstop Points has partnered with CardRatings for our coverage of credit card products. Nonstop Points and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. This post may contain affiliate links; please read our advertiser disclosure for more information

Ever since I learned about the significance of points and miles and their usefulness for reducing the cost of travel, I have tried to earn as many of these loyalty rewards as possible. I quickly learned that there are countless ways to earn points and miles but not all methods are created equally.

Simply put, the goal of strategic earning is to collect as many miles as possible without changing your day to day spending behaviors. If you intentionally spend more money to earn more points, it will reduce the ultimate value of the rewards.

There are countless ways to earn points and miles, but generally speaking, these are the most common methods that apply to multiple programs.

Direct Earning

When I say direct earning I am referring to the ability to earn points and miles in the most straightforward way the program is intended to provide rewards.

For example, the most straightforward way the Marriott Bonvoy Rewards program is meant to deliver rewards is from a paid stay at a Marriott property. Since the amount of points earned is tied to the cash value spent at the hotel, this encourages further spending with Marriott in order to earn more rewards. When you spend more with the program, reward earnings proportionally increase. For Marriott hotels, one receives 10 points per dollar for the base room rate and before any potential bonus points are applied.

The same holds true for American Airlines who gives members 5 points for every dollar spent on the airline before taxes, fees, and any bonus miles. When you buy a more expensive ticket, increasing revenue for American Airlines, you will earn more miles.

But, miles earned per dollar spent does not apply to all programs. Some, such as Alaska MileagePlan, earn miles based on the distance flown and fare type regardless of the cash price. This means that cheap flights and more expensive flights alike will reward you the same number of miles as long as they are booked as the same class. Think about a flight from Washington D.C. to Los Angeles, which spans 2300 miles. While you may earn a bonus of ~ 200% miles if you fly first class, you will typically earn 2300 miles for this flight regardless of if you paid $173 on a Wednesday in September or $459 the day before Christmas.

Each of the programs mentioned and the other ones in this category act similarly: points and miles are earned for interacting with the brand and for your loyalty over the course of time. Once these rewards accumulate, you will be able to use them towards more flights or hotel stays.

Partner Programs

Partner programs are a challenging topic to discuss due to the countless ways in which you can earn rewards from a plethora of partners with which these companies (ex. American Airlines) have established relations.

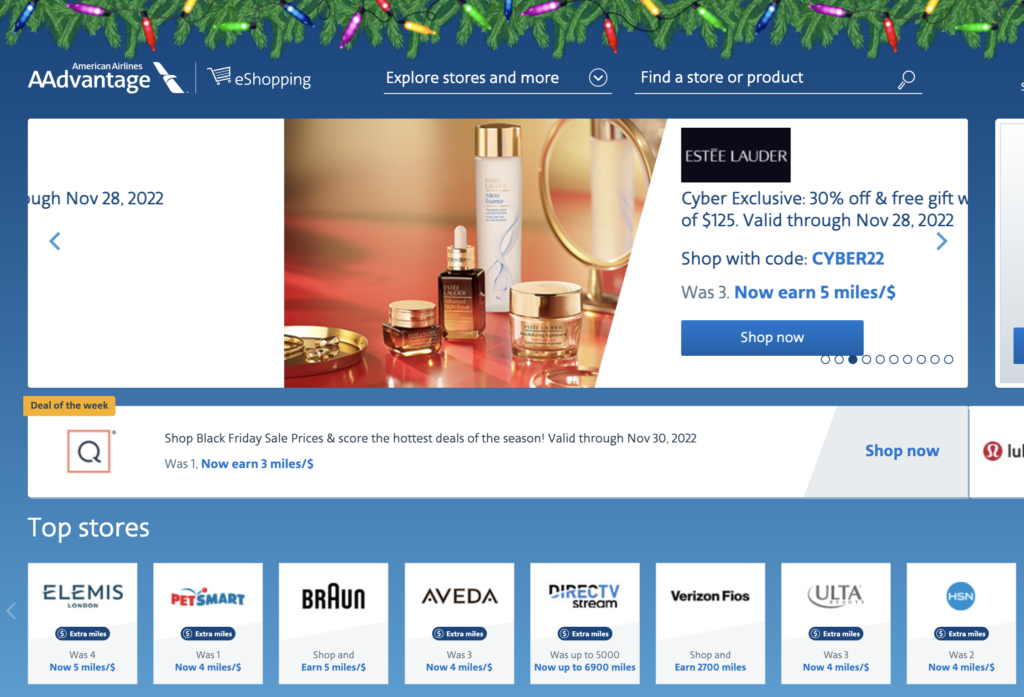

One partner example is AAdvantage Eshopping. When you go to their website to use their shopping portal, you will be able to select from a variety of stores from which to shop, for example Apple or Nike. When you click on the desired store via the portal, you can make the same exact purchase as you would if you went into the store or went directly to the store’s website. However, when you make the purchase through the portal, American will get a commission of your sale and pass on part of the earnings to you in the form of points and miles. By shopping through the portal, you get the desired item(s), points earned from whichever credit card you are using, as well as the points/miles bonus for using the portal.

For example, if AAdvantage eShopping offers 6 American Airline miles per dollar spent (before taxes or shipping) and you spend $150, you earn 900 miles. While this one purchase may not sound significant and isn’t enough to buy you a plane ticket, the miles add up over the course of a year’s on-line spending. By using shopping portals to make purchases for my everyday needs, I’ve actually earned enough miles to fly to Europe .

This program is similar to others such as AAdvantage Dining or additional dining options, which function the same as shopping portals but instead of selecting a store from which to shop, you can choose from a variety of restaurants.

Another type of reward partnership includes airline alliances. American Airlines and British Airways are both part of the One World alliance, which means that if you fly British Airways from London to Greece, you can opt to earn American Airline miles instead of British Airways Avios.

When you really start looking into it, you realize just how many airlines have similar agreements such as Air France and Delta, United and Lufthansa, and so many more. Even non-alliance agreements sometimes exist, which allows you to earn miles when flying on an airline partner such as earning American Miles from flying JetBlue.

The depth of partner programs runs deep. Earn Southwest Rapid Rewards miles when renting a car with Hertz. Earn Delta SkyMiles miles when buying a cup of coffee at Starbucks. Earn Marriott Bonvoy Rewards when you take an Uber or order Uber eats. You can even earn American Airlines Miles when staying with Hyatt hotels in addition to earning Hyatt points. Love it when you can double dip the chip!!

It is impossible to list every partnership or way to earn reward currencies, but as long as you are on the lookout, it shouldn’t be too difficult to earn points and miles on nearly every dollar you spend.

Credit Cards

One of the most notable ways to earn points and miles, besides directly staying or flying with a particular program, is through the maximization of credit cards. This is so much the case that some airlines often earn more from credit card rewards through their loyalty than from actually flying people.

Simple put, credit cards operate as an agreement between banks and loyalty programs (all travel for the purpose of this article). Banks buy points and miles from airlines and hotels and use them to encourage consumers to use their cards.

Every time you swipe a credit card at the store, that store pays an interchange fee, typically around 2% -ish to the credit card companies. The credit card company uses a portion of this fee to buy miles, which they give to you for using their credit card, pay Mastercard or Visa their fee, and then retain the rest towards their bottom line.

Credit cards are great for earning rewards since every transaction, whether the store has a direct partnership with a travel company or not, will earn points and miles (and if they do you can likely double dip and get both benefits).

The downside is that rewards don’t build that quickly as it takes $15,000 in spending on a card that earns 2x miles at grocery stores before earning 30,000 miles. This is where credit card sign-up bonuses come in handy, allowing you to earn 60,000-100,000+ points or miles after spending a minimum amount of money, typically $3,000ish, on the card within a certain time frame of opening the card. Usually, this is about three months.

Sign-up bonuses allow you to rapidly increase the balance of your rewards without breaking the bank, and, alone, can be enough for multiple free nights in a hotel or round trip flights.

The Last Point

At the end of the day, I barely scratched the surface describing different ways you can earn points and miles, but I hope you have a good idea of some of the different ways in which you can accrue these currencies. While some methods are easier than others (and cheaper than others), over the long run the balances really start to add up.

Just the idea that you could earn hundreds of thousands of miles without changing your lifestyle is an awesome concept. Who knew that buying baguettes at the store could eventually buy you a free flight to France.

Nonstop Points has partnered with CardRatings for our coverage of credit card products. Nonstop Points and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. This post may contain affiliate links; please read our advertiser disclosure for more information

Leave a Reply